Condo Insurance in and around Seminole

Welcome, condo unitowners of Seminole

Cover your home, wisely

Your Belongings Need Protection—and So Does Your Condo.

Because your condo unit is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to smoke or wind. That's why State Farm offers coverage options that may be able to help protect your largest asset.

Welcome, condo unitowners of Seminole

Cover your home, wisely

Put Those Worries To Rest

Despite the possibility of the unexpected, the future looks bright when you have the excellent coverage that Condo Unitowners Insurance with State Farm provides. More than just protection for your unit and personal property inside, you'll also want to check out liability coverage possible discounts, and more! Agent Tim Tran can help you build a policy based on your needs.

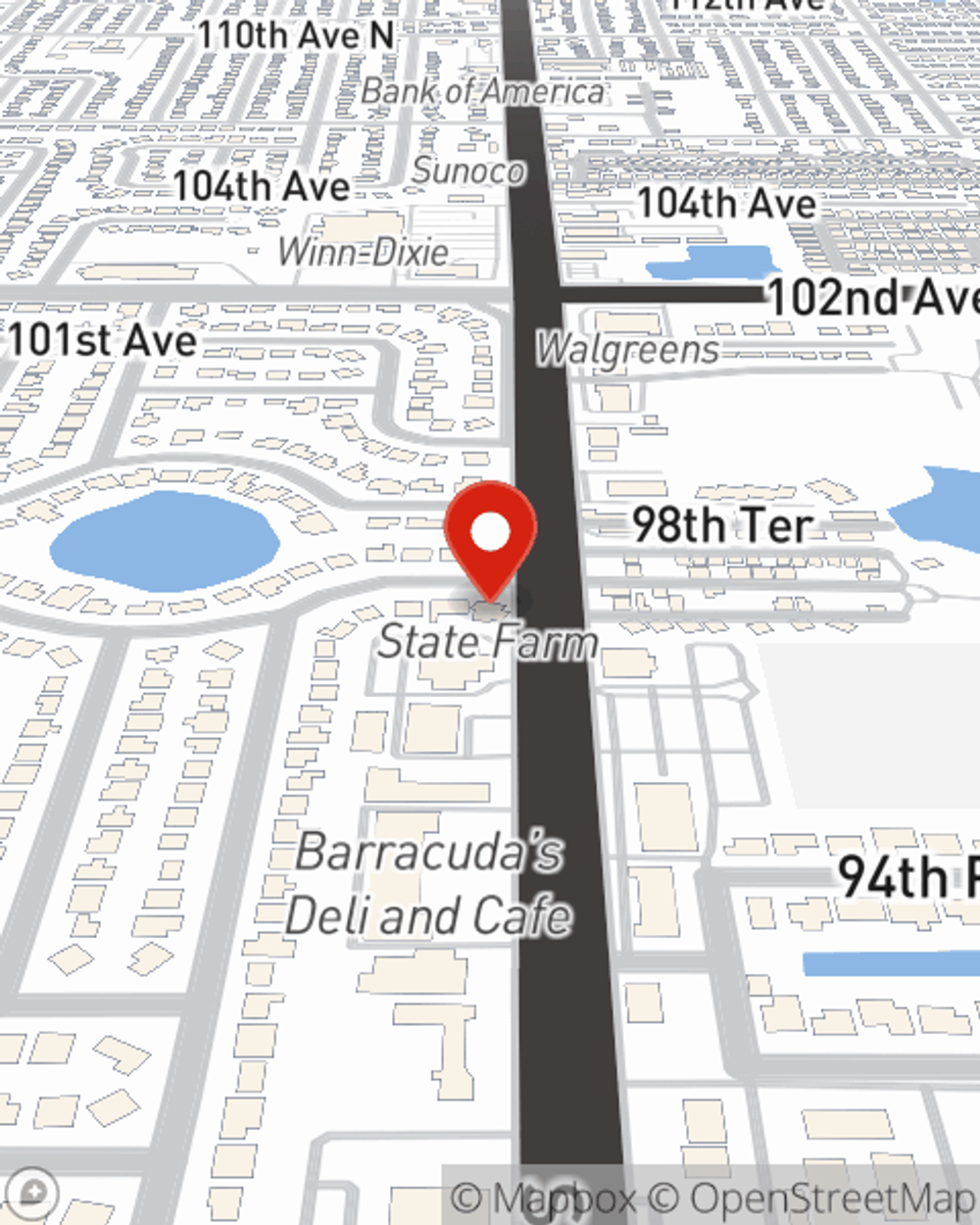

If you want to learn more, State Farm agent Tim Tran is ready to help! Simply call or email Tim Tran today and say you are interested in this wonderful coverage from one of the leading providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Tim at (727) 391-0127 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.